Par Hubert Kempf

In the European debate surrounding the Next Generation EU plan, the European Commission’s decision in 2020 to issue debt for the benefit of the Member States is often compared to the decision taken by the US federal government in 1790, under the impetus of Treasury Secretary Alexander Hamilton, not only to honor the outstanding federal debt but also to assume the debts of the federated states. This comparison is specious. Hamilton’s financial policy went hand in hand with the ability to raise the taxes needed to service the debt, made possible by the use of military force. This is in stark contrast to the situation in the European Union, where the Commission has no coercive powers whatsoever.

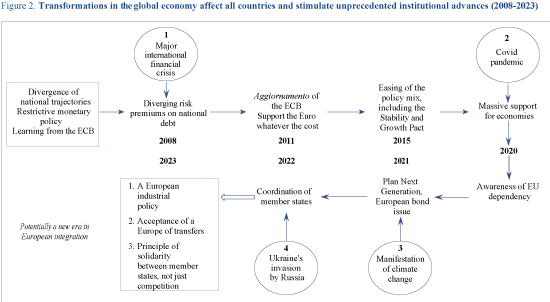

The European Council’s decision (of 21 June 2020, confirmed on 14 December 2020) to authorize the European Commission to respond to the crisis opened up by the Covid-19 pandemic with a 750 billion debt issuance program in order to lend at low rates or make unrequited transfers to the Member States represents a political and economic innovation that cannot be underestimated or ignored. Many commentators have hailed it as the “Hamiltonian moment” of the European Union. The expression was coined in 2011 by Paul Volcker, former Chairman of the US Federal Reserve from 1979 to 1983 and then Chairman of the Economic Recovery Advisory Board appointed by Barack Obama. Referring to the situation in Europe, Paul Volcker said “Europe is at an Alexander Hamilton moment, but there’s no Alexander Hamilton in sight“[1] .

The expression has become popular and has been used by many commentators, journalists and politicians. It refers to the budgetary and fiscal policy proposed, negotiated and implemented by Alexander Hamilton in 1790[2]. Appointed by George Washington as Secretary of the Treasury on 11 September 1789, after Congress had created the post on 2 September, Hamilton immediately set about drafting a report that became a landmark in American history. In this report[3], Hamilton proposed not to default on the outstanding federal debt, to apply the same treatment to all holders of federal debt securities, regardless of when they were acquired, and to transfer the outstanding debts of the federated states to the federal government.

However experts discuss the relevance of the parallel drawn between the decision on federal public finances taken by the American Congress in 1790 and the announcements made by the European Commission in 2020. They conclude that the programs and circumstances differ so substantially as to render this parallel[4] meaningless. These discussions, centered on economic considerations, are useful. But they miss the critical point: the political impact of these acts.

No one disputes the importance of Alexander Hamilton’s fiscal and financial policy in American political history. For three reasons:

1/ an immediate and spectacular recovery in the creditworthiness of the US federal and state governments on the international financial markets;

2/ the structuring of the American political debate between the Federalists and the Republicans at the time, which continues today where references to the Hamiltonian and Jeffersonian traditions are still very much alive[5] ;

3/ Hamilton’s intellectual power, which led him to develop an analysis of the workings of the financial markets that was far ahead of its time[6].

As for the significance to be attached to the announcements by the European authorities, at the risk of being contradicted by future developments, let us say that it is relevant to see in these announcements an obvious innovation: it is now openly accepted by all the countries of the European Union that the European Commission can exercise significant budgetary powers in the event of exceptional circumstances (without any precise definition of what exceptional circumstances are). What’s more, the principle of conditionality for aid granted to Member States is also endorsed by the European Council, which clearly puts the European Commission in the position of an umpire and gives it discretionary power over Member States. But these developments are more of an expedient, and do not result in any change in the institutional relationship of power between the Member States and the Union’s bodies (the European authorities).

From this perspective, it is reasonable to refer to the Hamiltonian moment of 1790 in order to assess how innovative the 2020 decision is. In both cases, there is a budgetary decision that modifies the financial relationships between the member jurisdictions of the unions. More specifically, the federal level in the case of the United States, and the supra-state level in the case of Europe, assume responsibilities that were or could have been the responsibility of the federated or national Treasuries of the union. It is clear that this advance may involve a major, if not radical, change in the political relations between jurisdictions.

But this point of comparison alone is not enough. If Hamilton’s fiscal and financial program has been the undisputed success that it is acknowledged to be, this is neither due solely to the passage of the law, nor to its translation into complex financial regulations.

To understand this, we need to single out a second “Hamiltonian moment”. This moment took place in 1794, during the “whiskey rebellion” that shook the west of the 13 American states that then made up the United States[7].

This rebellion[8] stems from the law passed by Congress in 1789 stipulating that excise duties could be levied by the federal state. Note immediately the difference with the European case: as soon as the Constitution had been adopted (after its ratification by 9 of the 13 American states), the first Congress exercised its right to levy the tax granted to it by the Constitution, unlike what was provided for in the Articles of Confederation. This right is not available to the European Parliament, let alone the Commission. As early as 1790, Hamilton proposed levying a tax on whiskey. This was a logical choice: whiskey was an ideal product to levy a tax on at a time when communication routes were difficult and trade within the Union was limited. A non-perishable and transportable product, it concentrated in a small volume a large but perishable agricultural production and was easy to trade. It was also easy to control ˗ and therefore to tax ˗ because there were few crossing points. But its production is concentrated in a few counties in the western part of a few states, whereas it was consumed throughout the country. The proposed tax was therefore seen by whiskey producers as a major discrimination against them, since they would be the only ones to bear it to the benefit of the entire Union. Congress, aware of the problem so created, refused to pass the law. It did, however, pass it the following year, a year after the law on the regularization of public debts, in view of the need to fill the federal government’s coffers, in particular to assume the burden of the federal debt increased by its decision of 1790.

It wasn’t long before unrest began to take hold from 1791 onwards, especially in the western counties of Pennsylvania, encouraged by opponents of the Federalist party led by Hamilton. The tensions soon became a political issue, pitting the Federalists, supporters of a strong, interventionist state controlled by the social and educated elites, against the Anti-Federalists, who were to form the core of the Republican party led by Jefferson. The Federalists, then in power, felt that the authority of the (federal) state was in question and that this was a prodrome of the return to the anarchy that prevailed before the vote on the Constitution of 1789. According to Hamilton, it was becoming urgent to take action against the rebels, but George Washington, the President and, as such, head of the army, delayed.

In August 1794, the refusal of the tax led almost 6,000 armed opponents to mobilize. They were soon on the point of taking control of Pittsburgh. After yet another failed attempt at conciliation, Washington decided to take military action against the rebels. It ordered the raising of 14,000 militiamen from New Jersey, Maryland, Virginia and Pennsylvania. Faced with such a deployment of force (larger than the continental army that had held out against the British), the rebellion immediately collapsed. The rebels dispersed. The leaders were arrested and put on trial. Two were sentenced to hanging and finally pardoned by Washington. The conclusion of the affair was drawn by Hamilton: “The insurrection in the end will have benefited us and added to the solidity of everything in this country”[9]. This was particularly true for the financial soundness of the federal state.

This second moment sheds light on the first moment of 1790, that of the drafting of Hamilton’s report and the adoption of the law he submitted to Congress. There were two reasons for the speed and determination with which Hamilton conceived his budgetary and financial policy, in addition to the catastrophic financial situation in which the young republic found itself, its credit then at an all-time low. The first, acknowledged by historians, financial professionals and politicians alike, was his expertise in these matters, exceptional for the time, which led him to devise a bold and complex plan. This plan was little, if at all, understood by his contemporaries and in particular his opponents, led by John Adams and Thomas Jefferson, but it is easily understood today when it is recognized that financial credibility (defined as the temporal coherence of a debt plan) is a central element in the determination of interest rates. The second, just as important, is that Hamilton was confident in the capacity of the federal state of raising the tax revenues needed to service the debt. This implies being able to levy taxes effectively. Hamilton had been a brilliant officer in the War of Independence, noted by Washington for his bravery and military intelligence, so much so that he made him his aide-de-camp and was thus able to measure his intellectual, political and military qualities. Hamilton knew the power of guns[10] as well as the weight of words. In the face of the tax rebellion, he did not hesitate to advocate the exercise of the federal government’s monopoly on legitimate violence and convinced the President to quell the rebellion in the West.

This second moment at the end of the eighteenth century is exemplary of the ability of the nascent American federal state to balance its budget, to service its debt, even when augmented by the debts of the states, and thus to avoid default. Without this ability, it is doubtful that the stroke of genius attempted by Hamilton in 1790 would have been so successful.

This episode cruelly highlights the difference with the European situation in the 2020s. At no time, and for good reason, did the President of the Commission clearly mention how the debt issued would be repaid. A fortiori, she was unable to declare that the European Union would levy taxes ˗ it does not have the power to do so ˗ or that she would, if necessary, mobilize the means of coercion and constraint on recalcitrant Europeans, since she has none at her disposal.

It is easy to understand why European “federalists” (so designating supporters of strong supranational European institutions, for want of a better name) have seized on the expression “Hamiltonian moment” to describe the European Commission’s adoption of its recovery plan. Placing itself under the prestigious patronage of Hamilton, and comparing this plan with the proposals made to Congress in 1790 and brilliantly defended by Hamilton, makes it possible to suggest that the European Union, more than two centuries apart, is following a fairly similar path to that taken by the American republic, namely the gradual but obstinate constitution of a federation, a hierarchical inter-governmental entity dominated by the federal state. But this is to take too much liberty with history and to pay more lip service to it than to reality.

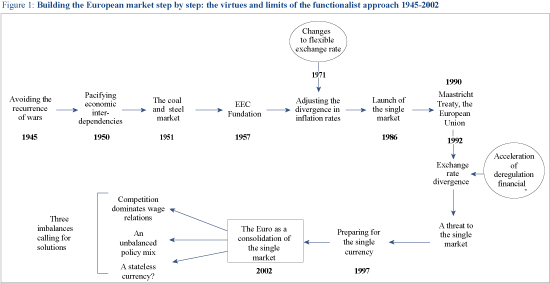

The history of the American union is very different from the history of the European union. The American union was born in 1787-1789 from the realization that the confederation born in 1776 was failing, due to the inability of the American states to cooperate effectively. From the outset, it was characterized by a desire for the pre-eminence of the federal state. It certainly took time for the federal state to establish itself and realize its full potential. The relationship between the federal state and the federated states is always subject to change. We are currently witnessing a wave of promotion of the federated states, in particular by the current Supreme Court. But such movements are not new and do not significantly alter the political, social and economic dominance of the federal state[11]. This should come as no surprise: this pre-eminence is enshrined in the founding texts of the American republic and can be seen in the political twists and turns of its early years, as is clearly demonstrated by the policies sought and promoted by its most brilliant and effective leader, Alexander Hamilton. This is clearly shown by the two ‘Hamiltonian moments’ of the 1790s, which cannot be thought of in isolation from each other. The first Hamiltonian moment induces us to compare Hamilton’s American fiscal policy at the end of the eighteenth century with the European announcements of 2020 in response to the Covid-19 pandemic. The second Hamiltonian moment, however, makes it easier to see the differences between the two sequences, and illustrates how American federalism is not a prefiguration of developments in the European Union. The early years of the American republic, far from highlighting a congruence between American destiny and European trial and error, instead show their marked differences. The construction of Europe had nothing to do with the founding of the United States and did not follow the federalist path followed by the latter.

In short, one moment is not enough to make history. European leaders and citizens would be well advised not to forget this lesson from the early days of the American federation.

[1] See Wheatley (2012), “Analysis: What Europe can learn from Alexander Hamilton”. Reuters.

[2]The reference biography on Hamilton is Chesnow, Ron (2005), Alexander Hamilton, Penguin Books…

[3] Hamilton, Alexander (1790), Report Relative to a Provision for the Support of Public Credit, U.S. Treasury Department

[4]See in particular the very detailed contribution by Elie Cohen (2020). See also Issing (2020) and Gheorghiu (2022).

[5] See Banning, Lance (1980), The Jeffersonian persuasion: Evolution of a party ideology. Cornell University Press.

[6] Thomas Sargent (2012) has no difficulty in interpreting Hamilton’s thinking and actions in the terms of the most recent economic theory, born of the rational expectations revolution and the notion of temporal coherence.

[7]See Krom and Krom (2013).

[8]We follow the developments dedicated to the rebellion by Gordon S. Wood (2009), Empire of liberty. A history of the Early Republic, 1789-1815, Oxford University Press, pp. 134-139.

[9]Alexander Hamilton to Angelica Church, 23 October 1794, Papers of Alexander Hamilton, Vol. 17, p.340, quoted in Wood (2009), p.138.

[10]“Ultima ratio regum”, as others before him had claimed.

[11]I was already arguing this in the 1980s, proving that the issue is not new. Cf. Kempf and Toinet (1980).