Pourquoi le chômage des jeunes résiste-t-il à des moyens inédits ?

Bruno Coquet L’emploi des jeunes : une veille histoire La France est depuis longtemps à la peine en matière d’emploi des jeunes[1]. Les jeunes sont relativement […]

Bruno Coquet L’emploi des jeunes : une veille histoire La France est depuis longtemps à la peine en matière d’emploi des jeunes[1]. Les jeunes sont relativement […]

Jérôme Creel, Fipaddict, Clara Leonard, Nicolas Leron et Juliette de Pierrebourg Comment sortir du dilemme entre épuisement planétaire et contraintes budgétaires dans lequel se trouvent […]

La prévision de printemps de l’OFCE pour l’économie française, publiée aujourd’hui, indique un taux de chômage prévu à 8,2 % fin 2024 et 8,1 % fin 2025. […]

Christophe Blot et Francesco Saraceno Le taux d’inflation dans la zone euro poursuit sa baisse amorcée depuis plusieurs mois et s’élève à 2,6 % en février, […]

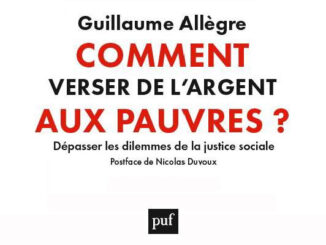

Guillaume Allègre Comment aider les pauvres ? La question se pose depuis au moins les débuts de l’économie comme discipline. En 1798, le fameux Essai sur […]

Françoise Milewski Le développement de l’emploi à temps partiel des femmes avait été une caractéristique majeure des décennies 1980 et 1990. De l’ordre de 16 […]

Sandrine Levasseur Le 30 janvier 2023, l’OFCE a organisé une Conférence-débat sur le thème du « Green Deal dans l’agriculture » . L’objectif était d’aborder les principaux […]

Muriel Pucci, CES Université Paris 1 et OFCE Sciences Po On peut lire sur le site solidarites.gouv.fr « La prime d’activité est destinée aux travailleurs aux […]

Anissa Saumtally et Benoît Williatte Les prévisionnistes de l’OFCN en désaccord sur la croissance en 2024 La première estimation de la croissance du PIB français […]

Hubert Kempf Javier Milei, libertarien revendiqué, a été élu président de la République argentine le 19 novembre 2023 sur un programme électoral qui intégrait la […]

Copyright © 2024 | Thème WordPress par MH Themes