Regardless of the outcome, uncertainty in trade policy will have significant effects on global trade

Author

Introduction

Following Donald Trump’s announcements regarding a general increase in bilateral tariffs, April 2, 2025, will go down in economic history books as “Liberation Day.” Although the announcements on April 2 are particularly detailed, they follow a long list of announcements that marked the beginning of Donald Trump’s second term as President of the United States. The Peterson Institute attempts to trace the exhaustive timeline of announcements from the new administration. For the month of March 2025 alone, the institute recorded 15 major announcements concerning bilateral relations with China, Canada, Mexico, the European Union, and various trading partners in specific sectors (wood and steel). According to D. Irwin, the implementation of Trump’s announcements would raise U.S. tariffs to their highest level since World War II, well before “Liberation Day.”

In the first quarter of the year, the actual increase in tariffs has been slower than the verbal threats. Nevertheless, this does not mean that the prevailing climate of trade war has no consequences for the global economy. On average, in January and February, U.S. goods imports were 10 points higher than their December level. This strong momentum could be explained by importers’ desire to build up stocks of foreign products before their likely price increase.

A Certain Rise in Trade Uncertainty

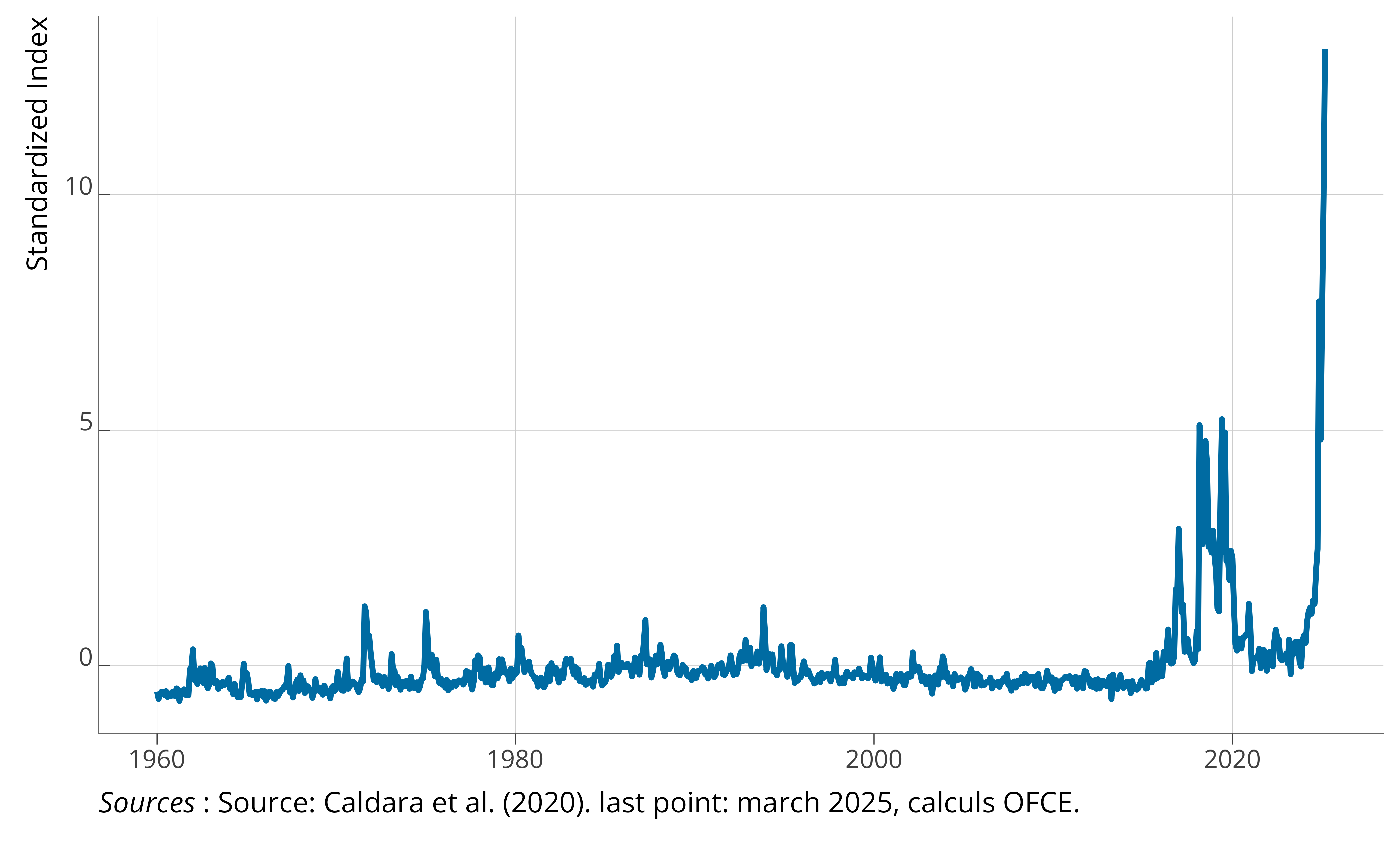

Although the increase in trade barriers has so far remained largely at the threat stage, at least until April 2, the context does not bode well for the continuation of the status quo. Caldara et al. (2020) have constructed an index that attempts to measure the extent of uncertainty surrounding U.S. trade policy. This index is based on press articles from seven newspapers1. According to the authors, this indicator is strongly correlated with the volatility of U.S. tariffs.

1 The newspapers used are: Boston Globe, Chicago Tribune, Guardian, Los Angeles Times, New York Times, Wall Street Journal, and Washington Post.

In March, the index constructed by Caldara et al. (2020) reached a historically high level (13 times higher than its historical standard deviation) and reflects the historical magnitude of the current tensions (graphic 1).

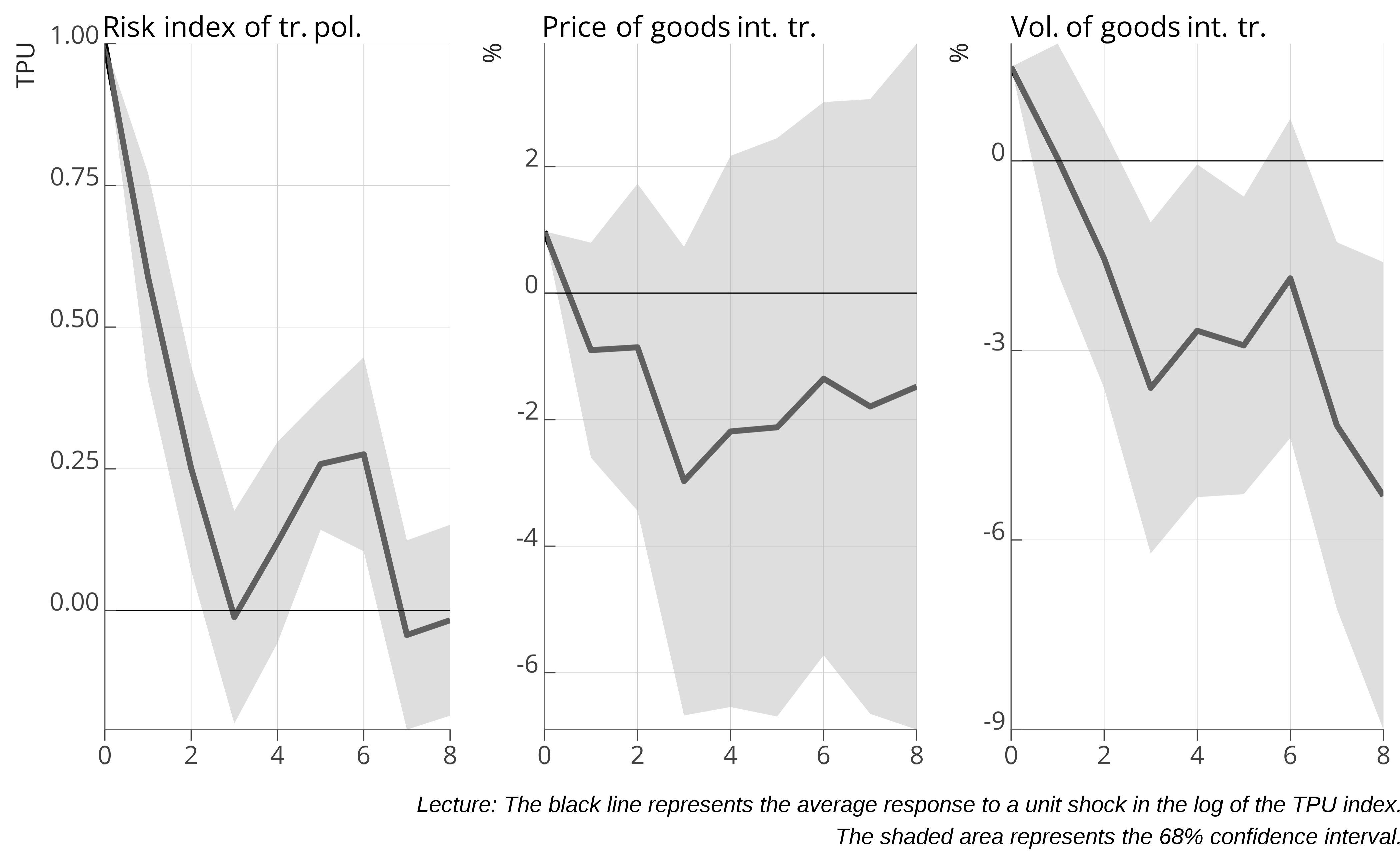

To evaluate the effect of such a level of uncertainty, we used the methodology presented in Sampognaro (2022) to model the impacts of an uncertainty shock on global goods trade. For this purpose, we constructed a model linking the U.S. trade policy uncertainty index, the implicit tariff rate, the goods trade price index, and global goods trade volume2. The model is estimated from the year 2000 due to the availability of monthly data from the CPB. To identify the causal effect of uncertainty shocks on other variables, a chronological order of causal links was assumed, as in Sampognaro (2022)3.

2 This data is produced by the CPB, except for tariffs, which are calculated as the implicit tariff rate derived from BEA data.

3 The following causal order among variables was assumed: (1) trade policy risk, (2) implicit tariff rate, (3) international trade prices, and (4) global trade volume.

With Concrete Effects on the Global Economy

According to our estimation, an unexpected unit variation in the logarithm of the trade policy uncertainty index (TPU) results, in the very short term, in a slight increase in global goods trade volume (graphic 2) following the uncertainty shock (+1.5% during the first month). These variations could be explained by the reaction of importers who attempt to build up stocks of goods to circumvent potential future trade barriers. Exporters would also increase their prices, as evidenced by our estimation of a rise in the goods trade price index (+1.0%) in response to a trade policy uncertainty shock.

However, these effects are only short-term. A trade policy uncertainty shock has significant impacts on international trade in the medium term. According to our estimation, nine months after the onset of the uncertainty episode, the volume of goods trade would remain significantly depressed (-5 points). At the same horizon, the effect on prices would not be significant.

The question that arises today is whether “Liberation Day” marks the end of the phase of uncertainty4 or if this type of effect will remain significant in understanding the developments of the global economy. Donald Trump seems to suggest that negotiation remains possible, but he says so from a position of strength. Even if the trade war remains at a verbal stage, the scars on the global economy could be lasting. This suggests that economic actors may adopt a derisking strategy (Cerdeiro et al., 2024) in the face of uncertainty about the cost of their foreign purchases. Thus, value chains would turn away from foreign suppliers when the future price of purchases becomes more uncertain5.

4 And the beginning of the concrete effects of the actual change in tariffs.

5 Or access to foreign suppliers if the uncertainty relates to non-tariff barriers.

In the current situation, it should be noted that the trade policy uncertainty index (in logarithm) stands at a level 1.4 units higher than the level preceding Donald Trump’s election in October 2024. According to the model estimated here, international trade could remain durably impaired (at least until 2026) due to the ongoing tensions and could have non-negligible consequences on global supply chains.